Black Monday 2.0: During a Global Economic Reset, boring sectors are a safe-haven.

The echoes of “Black Monday” reverberate as we witness another sharp decline in the FTSE 100, now at its fastest rate since the 2020 pandemic and still falling as we write this article. The global economic landscape is once again facing unprecedented challenges, from rising inflation and supply chain disruptions to geopolitical uncertainties that seem to shift the markets daily. Investor confidence is collapsing as fear spreads, businesses are being forced to reassess their strategies in response to the enormity of the market reset because of the USA’s launch of trade tariffs on all nations. Yet, in the face of such uncertainty, some companies are not retreating; they are advancing. Ambrey Baker is one of those companies.

Over the years, we have learned to thrive in times of turmoil. In fact, our greatest periods of growth have come during some of the most trying times. Take 2008, for example. While the financial crisis led to widespread contraction, Ambrey Baker experienced expansion. While many companies scaled back, we saw opportunity and emerged stronger. Fast forward to the pandemic, when the world was plunged into lockdowns, and the uncertainty was palpable. Yet, in the five years since those lockdown restrictions were enforced, Ambrey Baker has more than doubled in size. This growth was not coincidental. It was a direct result of our continued focus on what we do for industries that are essential, regardless of economic cycles.

Unlike many businesses that chase the latest trends or ride on the coat-tails of consumer fads, Ambrey Baker has steadfastly focused on non-discretionary industries that people cannot live without: Food, Pharmaceuticals, and Logistics. These are often disparagingly referred to as boring or Steady-Eddy sectors. However, when the economy contracts, when inflation rises, when global supply chains falter, these sectors remain stable. People still need to eat. They still need access to medicine. Goods still need to be delivered, and supply chains must continue to function. Re-assuring boring but safe! We have built our business around these pillars, and this unwavering commitment to essential industries has shielded us from the cyclical downturns over our 40 year history that others have struggled to navigate.

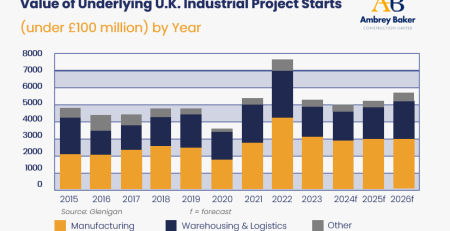

But resilience is not only about being in the right industries. It is about anticipating challenges before they arise and adapting quickly when the landscape shifts. The tariffs, however, are a significant factor in this uncertainty. US President Trump has made it clear that his administration’s trade policies are here to stay, with new tariffs specifically affecting a wide range of imports. From a 10% baseline tariff on all imports to higher duties on numerous countries deemed “worst offenders,” the global market is facing higher costs, and supply chain disruptions are widespread. For companies relying on exports to the US, the impact is immediate, as businesses scramble to adjust to the new reality of increased tariffs which are effectively another tax on the price of the goods they sell to American consumers and companies. This could signal the end of globalisation as we know it, with many experts predicting a shift towards re-shoring, or the return of manufacturing to home markets, in an effort to mitigate the risks associated with trade tariffs and to regain control over supply chains.

It is also worth noting that these strategic decisions align closely with the investment philosophy of some of the most successful investors in the world, particularly Warren Buffett. As of March 2025, Buffett’s portfolio remains heavily weighted in food and beverage stocks, such as Coca-Cola, Kraft Heinz, Kroger and others, reflecting his long-standing belief in the stability and growth potential of these essential industries or defensive markets as others refer to them. Buffett’s approach is simple but profound: In times of uncertainty, invest in what is essential. His investments in food and beverage companies show that even in a turbulent economy, the fundamental needs of people remain constant. This mirrors Ambrey Baker’s own strategy, which focuses on industries that are crucial for daily life, irrespective of the wider economic environment.

The truth is that the global economy will always experience fluctuations, some larger than others, to be fair! Markets will continue to rise and fall, and new challenges will arise. But businesses that focus on essential non-discretionary goods and services, that remain agile and adaptable, are not only more likely to weather the storm, but they are also more likely to grow and come out stronger on the other side. Ambrey Baker’s proven resilience, and growth, especially during challenging times, speaks volumes about our ability to navigate economic downturns without compromising on our commitment to our customers.

As we face these latest global challenges in trade and macroeconomics, Ambrey Baker stands firm. We were ready. We are building the future – a future grounded in the industries that people rely on. Our approach to business has never been about capitalising on fleeting trends or riding the wave of short-term growth. It is about investing in what endures. It is about staying true to our focus on the essential industries that sustain populations and nations, regardless of what the financial market corrections.

In the face of Black Monday 2.0, we remain calm and confident. This current turmoil will help support, if not accelerate, our latest 5-Year business plan, set to launch in May 2025. As we formalise and accelerate our current services, which focus on maintaining critical infrastructure and delivering capital projects, we are poised to adapt and grow even further. Our continued success during and after Covid is a testament to our resilience, strategic focus, and unwavering belief that focusing on essential industries will always provide the foundation for sustainable, long-term success.

For further information or enquiries regarding project coordination, refurbishment and maintenance delivery, lifecycle planning, and support within live operational environments, please contact:

Matthew Waldeck – Head of Client Solutions