AB Market Report: The Evolving Landscape of the EU Seafood Market in 2025

The European seafood industry is undergoing significant changes, driven by shifting consumer preferences, global trade dynamics, and economic pressures. The EU Fish Market Report 2024, published by the European Market Observatory for Fisheries and Aquaculture Products (EUMOFA), provides a comprehensive analysis of the sector’s current state. This report explores the key findings from the study, examining the latest consumption trends, trade developments, and industry challenges.

Market Trends and Aquaculture Growth

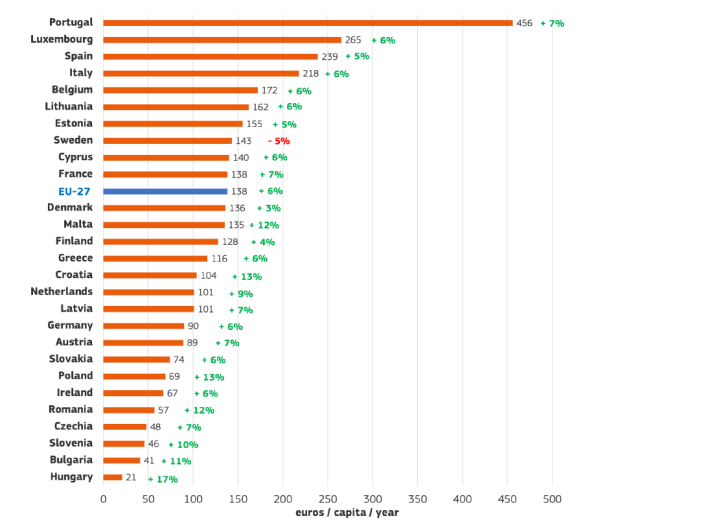

One of the standout trends in 2023 was the continued increase in seafood prices. Household spending on fishery and aquaculture products in the EU-27 reached €62.3 billion, marking a 6% rise from 2022. However, higher prices have led to a decline in at-home seafood consumption, particularly in high-consuming countries, where it fell by over 5% year-on-year. This drop aligns with broader inflationary pressures, which, despite easing from 2022 levels, remain a significant concern.

Despite this decline in wild seafood consumption, aquaculture has continued to expand, with per capita farmed seafood consumption reaching a decade-high of 6.82 kg per person in 2022. This shift is driven by sustainability concerns, affordability, and advancements in farming techniques that make aquaculture an increasingly viable solution for ensuring food security. The demand for farmed fish is also being reinforced by EU policies supporting sustainable aquaculture, making it a central pillar of the region’s seafood industry.

Trade flows in the EU seafood market have been undergoing a shift, with extra-EU imports decreasing by 3% to 5.9 million tonnes, while their value dropped by 6% to €30.1 billion. However, intra-EU trade remained stable, with a 45% increase in real value over the past decade, suggesting a stronger regional market. The UK, a key player in the European seafood trade, continues to adapt to post-Brexit dynamics, with initiatives such as the proposed development of the UK’s largest salmon farm in Grimsby demonstrating a growing focus on domestic aquaculture.

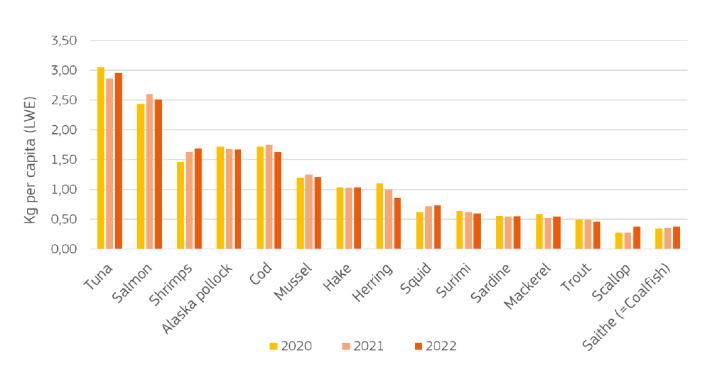

In terms of species-specific trends, salmon imports decreased by 4%, while cod quotas were reduced by 20%, leading to supply constraints. Shrimp imports dropped by 5%, reflecting changing sourcing strategies, and tuna imports saw a decline in volume while maintaining strong demand for processed products. Alaska pollock imports, on the other hand, increased by 6%, suggesting adjustments in supply chains to meet consumer preferences.

The UK’s role in seafood production is becoming increasingly significant, with plans for major aquaculture expansions aimed at reducing reliance on imports. The proposed Grimsby salmon fffarm is a prime example of how the industry is shifting toward domestic production, which could enhance the country’s self-sufficiency and improve its competitive position in the European market. Investments in cold storage, processing, and logistics infrastructure will be crucial to supporting this growth and ensuring that supply chains remain resilient amid market fluctuations.

The Future of the EU Seafood Market

Looking ahead, several key factors will shape the EU seafood industry:

- Sustainability and Regulation: As the EU continues to push for sustainable fishing and aquaculture, regulatory frameworks will evolve to support environmentally friendly practices.

- Consumer Preferences: The shift toward farmed seafood and processed products requires innovation in product offerings to align with dietary habits.

- Technological Advancements: Precision aquaculture, AI-driven monitoring, and automation will revolutionise seafood production and distribution.

- Regional Trade Resilience: Strengthening intra-EU trade and domestic aquaculture will help mitigate external market shocks and supply chain disruptions.

The EU Fish Market Report 2024 presents a clear picture of an industry in transition. While challenges such as rising costs and declining wild catch remain, the continued growth of aquaculture and regional trade offers opportunities for long-term stability. By investing in innovation and sustainability, stakeholders can navigate this evolving landscape effectively.

For a more detailed analysis, the full EU Fish Market Report 2024 is available at EUMOFA’s website.